Market Insights for Investors in Q2 2024

With the dust settling on the inflationary episode, ratification of a soft landing and the boom in the AI sector, equity markets continued their upward momentum towards new all-time highs in the first quarter of 2024. The timing of the first-rate cut is still tentative but the Fed’s indication towards achieving a soft landing proves to be a positive signal for the overall market to sustain its momentum. The S&P 500, Dow, and Nasdaq posted returns of 10.6%, 6.1%, and 9.3% respectively in Q1 2024. The S&P 500 outperformed the tech- heavy Nasdaq as broad-based rally continues its momentum on strong corporate earnings. The U.S 10-Year Treasury yield climbed to 4.2% in Q1 2024 from 3.9% in Q4 2023 as investors pared back expectations for deep Fed cuts this year. International stocks also performed well with developed markets returning 5.9% and emerging markets 2.4% respectively.

The economic environment has surprised many investors as inflation continues to fade. The Fed’s preferred measure of inflation, the Personal Consumption Expenditures index, rose 2.5% on a year-over-year basis for all prices and 2.8% when excluding food and energy, both significant improvements from their peaks only a year and a half ago. While some areas of inflation such as shelter and energy costs remain problematic, inflation is steadily moving back to the Fed’s long-term 2% target.

Meanwhile, unemployment is still under 4% despite layoffs in the tech sector, interest rates have been more stable with the 10-year Treasury yield around 4.2%, and stock market returns have broadened beyond artificial intelligence stocks. Despite these positive trends, some investors are concerned about the upcoming presidential election and the next phase of Fed policy. These worries are only amplified by the fact that the market is hovering near all-time highs.

In uncertain market environments, it’s more important than ever for investors to maintain a long-term perspective. Below are three key insights for understanding upcoming events and how they have historically affected investors.

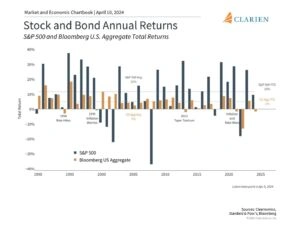

Steady economic growth has driven markets to new all-time highs

The S&P 500 has achieved 20 new all-time highs so far this year despite the brief market pullback during the first two weeks of the year. While this is positive for investors, it is easy to worry that continued market growth may not be sustainable. Do new all-time highs mean that the market is due for a pullback?

While price swings are an unavoidable part of investing, and the market does experience pullbacks from time to time, history shows that markets also tend to rise over long periods. During a bull market cycle, major stock market indices will naturally spend a significant amount of time near record levels, as shown in the accompanying chart. For instance, 2021 experienced 70 days with the market closing at new all-time highs, adding to the hundreds that were achieved since 2013.

Taking a long-term perspective allows investors to benefit from these market trends without constantly worrying about when a pullback might occur. Specific stock selection and holding an appropriately diversified portfolio can help investors to withstand market pullbacks without focusing too much on the exact level of the market.

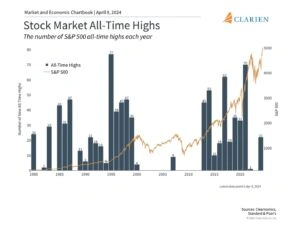

Markets have rallied through both Democratic and Republican presidencies

Coverage of the presidential election is heating up ahead of the November rematch between Presidents Biden and Trump. History shows that markets can perform well under both Democrats and Republicans. As the accompanying chart shows, the economy and stock market have grown over decades regardless of who was in the White House. What mattered more across these periods were the ups and downs of the business cycle. The Clinton years, for instance, benefited greatly from the long expansion of the 1990s. The George W. Bush years, on the other hand, overlapped with both the dot-com crash and the 2008 global financial crisis. Business and market cycles defined their presidencies, and not the other way around.

Of course, politics can impact taxes, trade, industrial activity, regulations, and more. However, not only do these policy changes tend to be incremental, but also the exact timing and effects are often overestimated. Thus, it’s important to focus less on day-to-day election poll results and more on the long-term economic and market trends.

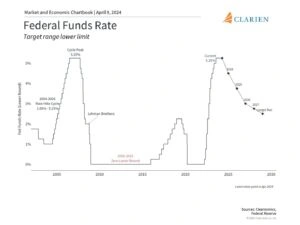

The Fed is expected to cut rates as inflation stabilizes

The market rally broadened beyond mega-cap technology stocks in the first quarter. The equal weight S&P 500, an alternative to the standard market cap-weighted index, hit a new all-time high in early March, a sign that a wider range of stocks is performing well. The positive economic outlook and the possibility of rate cuts have boosted optimism across many parts of the market.

Given this backdrop, the Fed is expected to cut rates later this year although the timing remains uncertain. The accompanying chart shows the possible path of the federal funds rate based on the Fed’s latest projections, including three cuts this year. At its last meeting, the Fed cited strong job gains and low unemployment as indicators of solid economic activity but emphasized that “the Committee does not expect it will be appropriate to reduce [interest rates] until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Regardless of the exact timing and path of Fed rate cuts, these projections represent a reversal of the emergency monetary policy actions that began in early 2022. For investors, it’s important to adapt to this changing environment and not focus solely on the events of the past few years.

With the US economy still intact, a presidential election approaching, and Fed rate cuts expected to begin later this year, we believe investors should stay fully invested while focusing on quality companies with strong balance sheets and cash flows going into the second quarter. With the recent developments in the AI sector, we are of the view that companies will be focusing on achieving operational efficiency particularly in sectors like software services, consumer services, financial services, health care equipment and services and media and entertainment. With the yields retreating in the first quarter pricing in three rate cuts instead of seven, we recommend having a neutral stance on duration as the odds of being surprised on the dovish or hawkish side are roughly balanced. For Investment grade and high yield corporate bonds, spreads are relatively tight compared to historical averages offering very little value as both outperformed treasuries in the first quarter. For buy and hold investors, we believe US Investment grade companies are still well positioned given their income potential and strong fundamentals.

The bottom line? Investors should stick to their financial plans while staying invested in the second quarter of the year. History shows that this is still the best way to achieve long-term financial goals.

This publication contains general information only and the Clarien Group of Companies, which include Clarien Bank Limited, Clarien Investments Limited, Clarien Trust Limited, Clarien BSX Services Limited and Clarien Brokerage Limited (collectively referred to as the “Group”) is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as the basis for any decision or action that may affect your business or your personal investment decisions. Before making any decision or taking any action that may affect your business or your personal investment strategy, you should consult a qualified professional advisor. The Group shall not be responsible for any loss sustained by any person who relies on this publication.

Clarien Bank Limited, through its wholly owned subsidiary companies, is licensed to conduct bank, investments, corporate services and trust business by the Bermuda Monetary Authority.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.